Sunday, August 27, 2006

Energy Consumption

There is no sign, yet, when oil price will subside. Alternative seems to be a hit word in energy world. Among oil, natural gas and coal are natural resources widely used to provide energy. Biofuel, synthetic gasoline, solar and wind attract lots of attention but still in the infant step.

Natural gas and coal can be converted to transporation fuel called GTL (Gas-to-Liquied) and CTL (Coal-to-Liquid) respectively. Natural gas has the least carbon, therefore it's the cleanest fuel. Yet, transportation of gas is not easy, either with pipeline or convert it to liquid form and transport it via ship. Natural gas price generally moves in tandem with oil price.

Coal is abundant - the supply is adequate for a century. Depending on the grade (anthracite, bituminous or lignite), the emission level of the chemical toxic is different. Coal always link with environmental issue.

Nevertheless, consuming of and relying on too much of oil during this volatile period do not seem to be a good idea. Coal should be a good replacement.

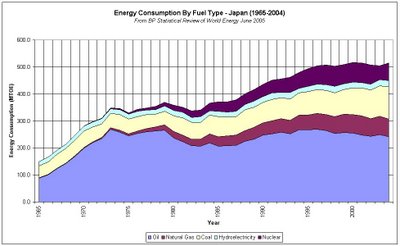

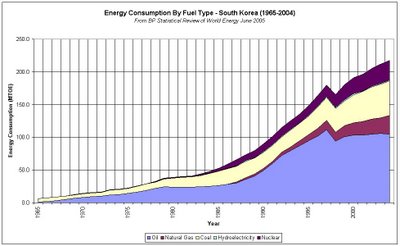

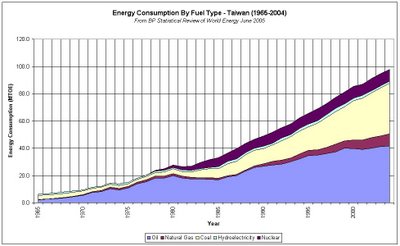

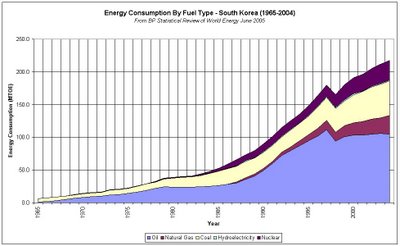

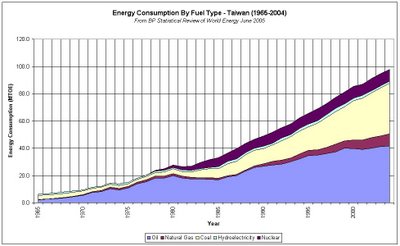

In Japan, South Korea and Taiwan, where natural resources is scarce, their economy depends less on oil. Four charts presented below shows the energy mix for these three countries and Thailand. It can be obviously seen that the oil consumption is stagnant in those three developed countries whereas in Thailand oil consumption is on the rising trend, albeit rising oil price.

Natural gas and coal can be converted to transporation fuel called GTL (Gas-to-Liquied) and CTL (Coal-to-Liquid) respectively. Natural gas has the least carbon, therefore it's the cleanest fuel. Yet, transportation of gas is not easy, either with pipeline or convert it to liquid form and transport it via ship. Natural gas price generally moves in tandem with oil price.

Coal is abundant - the supply is adequate for a century. Depending on the grade (anthracite, bituminous or lignite), the emission level of the chemical toxic is different. Coal always link with environmental issue.

Nevertheless, consuming of and relying on too much of oil during this volatile period do not seem to be a good idea. Coal should be a good replacement.

In Japan, South Korea and Taiwan, where natural resources is scarce, their economy depends less on oil. Four charts presented below shows the energy mix for these three countries and Thailand. It can be obviously seen that the oil consumption is stagnant in those three developed countries whereas in Thailand oil consumption is on the rising trend, albeit rising oil price.

My Investing Philosophy

The concept of value investing is very simple and logical. Buying shares at discount from its intrinsic value.

Intrinsic value of the firm is actually the future cashflow the firm can generate over its life discounted to present value. Several books delineate this issue in details. I believe everybody can master the calculation of intrinsic value with ease with the advent of spreadsheet software.

Vividly and unfortunately, future is abound with uncertainties and at best the intinsic value is just an estimate. Several parameters, such as growth rate, discount rate etc., assumed require knowledge on the industry the company operates and the company itself. This is so-called "Circle of Competence". The more you know the higher the chance you are right.

However, the margin of safety concept is also very crucial to guard against the ignorance and uncertainties.

Books recommended:

1. Intelligent Investor by Benjamin Graham

2. Warren Buffett Way by Robert Hagstrom

3. วัดมูลค่าหุ้นด้วยตัวคุณเอง โดย คุณสุมาอี้

Intrinsic value of the firm is actually the future cashflow the firm can generate over its life discounted to present value. Several books delineate this issue in details. I believe everybody can master the calculation of intrinsic value with ease with the advent of spreadsheet software.

Vividly and unfortunately, future is abound with uncertainties and at best the intinsic value is just an estimate. Several parameters, such as growth rate, discount rate etc., assumed require knowledge on the industry the company operates and the company itself. This is so-called "Circle of Competence". The more you know the higher the chance you are right.

However, the margin of safety concept is also very crucial to guard against the ignorance and uncertainties.

Books recommended:

1. Intelligent Investor by Benjamin Graham

2. Warren Buffett Way by Robert Hagstrom

3. วัดมูลค่าหุ้นด้วยตัวคุณเอง โดย คุณสุมาอี้

Saturday, August 26, 2006

Beginning of the Sojourn...

Really can't remember when investing is my interest. First company which my name appeared as its shareholder is Thai Airways International (THAI) when its IPO took place. Serious investment started during my summer internship when I bought Thai Petrochemical (TPI) (again IPO) and open my own trading account. Since then my portfolio value plunged into red and never recover. I sold out all my position and kept distance from the market.

Until 1999, when I had a chance to read "Tee Tak" written by Dr. Niwet, I realized, then and until now, that this is the way to make money in the stock market.

When I departed to Singapore for my post graduate study, I had read several books regarding value investing. From Peter Lynch to Warren Buffett and the list just goes on.

I started my own fund to invest in Stock Exchange of Thailand in May 22, 2002 with an aim to achieve at least 12-15% annual return by adhering to value investing philosophy.

So far, I am very satisfied with the results, total gain of 150% over the span of 4 years.

It works for me and I hope it will work for every investor as well.

Until 1999, when I had a chance to read "Tee Tak" written by Dr. Niwet, I realized, then and until now, that this is the way to make money in the stock market.

When I departed to Singapore for my post graduate study, I had read several books regarding value investing. From Peter Lynch to Warren Buffett and the list just goes on.

I started my own fund to invest in Stock Exchange of Thailand in May 22, 2002 with an aim to achieve at least 12-15% annual return by adhering to value investing philosophy.

So far, I am very satisfied with the results, total gain of 150% over the span of 4 years.

It works for me and I hope it will work for every investor as well.