Friday, March 20, 2009

Blog Moved

I am moving my blog to wordpress.com. Please visit the following link:

htp://valueinvestors.wordpress.com

htp://valueinvestors.wordpress.com

Sunday, February 22, 2009

CENTRAL PATTANA PLC (CPN)

Leader in retail mall development with firm expansion plan

Disclaimer: The author's opinions and estimations given in this article might be prejudiced although he has tried his best to maintain the neutral position. The data presented in this article is carefully verified by the author to ensure that it is as accurate as possible. However, he can’t ensure that there will not be any mistake. To use the information in the article for one’s own investing, the liability shall not be born to the author.

Introduction

CPN is a leader in retail mall development. By Sep 2008, it owns 10 shopping mall having net leasable area of 563,000 sq. m. In addition, it owns 144,000 sq.m. of office area. Revenue is generated primarily from rental fee in retail mall and office with small portion from food & beverage in the retail mall it operates. CPN also earns dividend income from the one-third interest in CPNRF, which owns 2 retail malls, Central Rama 2 and Rama 3.

CPN has plan to open additional 5-7 malls from 2009-2012 and thus expand its retail space by over 300,000 sq.m., a remarkable growth amid the economic crisis. As of this writing (21 Feb 2009), two shopping malls, Changwattana (63,000 sq.m) and Pattaya Beach Festival (54,000 sq.m), was opened. Central Chonburi (39,000 sq.) and Khonkaen (48,700 sq.m) will be opened by mid and late of this year. Three additional malls, Rama 9, Pre-Cadet School Site and Chiangmai2, are in the study phase, which, when completed, will add about 120,000 sq.m.to its retail mall portfolio.

The capital expenditure for the new projects is more than 20,000 billion Baht for the next 4 years.

Shopping malls developed by CPN has such a strong anchor tenant as Central Department Store and other retail specialties in Central Retail Group. Therefore, it is anticipated that the occupancy rate will not drop and it is able to increase the rental fee during this tough time. It would be able to ride the tough time and emerge stronger with its new projects.

With its growth story, this article attempts to determine the intrinsic value of CPN by discounted cash flow method.

Revenue Growth

Through its continuous shopping mall development between 2009 and 2012, the net leasable area for shopping mall is expected to increase progressively from 563,000 sq.m to 884,000 sq.m. or 58% increase. Assuming it can raise the rental fee by 5% annually and maintain an occupancy rate of 96%, its renting revenue for the retail mall will be increased from 7,100 MB in 2008 to 15,800 MB in 2015.

The office renting space will be increased from 144,280 sq.m to 171,280 sq.m in 2009 and no expansion thereafter. Assuming the renting fee is increased by 3% annually and maintain occupancy rate of 95%, its revenue will increase from 880 MB to 1,300 MB.

Revenue from F&B is also included but the contribution is minimal and not mentioned herein.

Gross Profit & EBIT

Gross profit margin is assumed to be 46%, 39% and 20% for retail mall rent, office rent and F&B respectively. By year 2015, total gross profit is expected to be 7,900 MB versus 3,700 MB forecasted for 2008.

Assuming SG&A expense of 20% of total revenue, EBIT for 2015 will be 4,365 MB.

Depreciation and Capital Expenditure

CPN, in Sep 2008, forecasted its capital expenditure for new projects and enhancement of over 20 billion for the next 4 years

For maintenance cost, it is set at 1.025 times the depreication. As for depreciation, CPN charges approximately 5% on in fixed asset annually. Thus, the estimated depreciation on new projects is set at the same rate.

Weighted Average Cost of Capital

As of Q3 2008, Debt to Equity ratio is 1:1. CPN has interest-bearing debt totaling 14,000 MB. Cost of equity and cost of debt is approx 10.69% and 5.4%. Therefore, weighted average cost of capital (WACC) is 7.24%. It is assumed risk free rate of 4.40%, market risk premium of 6.29%, beta of 1.0 and spread of 1.00%.

Present Value of Discounted Free Cash Flow

Free cash flow is calculated as per the following expression: FCF = EBIT(1-T) + DA – CAPEX – CWC. And it is discounted by the WACC of 7.24%. After year 2015, it is assumed no new project is developed and the FCF will increase by 3% for the rest of the period. Corporate tax rate is 30%. Change in working capital is assumed to be 0 as CPN has negative working capital. Present value to the firm is 40,780 MB. As of Q3 2008, CPN has net debt of 11,000 MB (Debt 14,000 MB and Cash 3,000 MB). Therefore the firm equity value is 29,780 MB.

In addition, CPN earns dividend income from the investment in CPNRF. Assuming a dividend growth of 2.5% per annum (Next year dividend of 0.88 Baht per share. CPN owns 33%), the present value of the dividend is 6,760 MB.

Therefore total equity value is 29,780 + 6,760 = 36,540 MB. Given its number of share outstanding of 2,178,816,000 shares, the equity value per share is 16.77 Baht.

Risks and Other concerns

As of writing, CPN is still negotiating with State Railway for lease extension at Central Plaza Ladprao. This evaluation assumed CPN will be granted the right for lease extension. It also assumes no erosion to the gross profit margin.

Post-Publishing Date

On 23 Feb 2009, CPN announced it has enter into agreement with CID to sub-lease the right in Central Ladprao (CID is the main leasor of the site from State Railway. The lease extension was approved). The transaction worth about 16,000 MB paying progressively during the lease period of 20 years which will expire in 2028. Shareholder's meeting will be held early March as this transaction requires shareholder's approval. No other details are available at present.

Disclaimer: The author's opinions and estimations given in this article might be prejudiced although he has tried his best to maintain the neutral position. The data presented in this article is carefully verified by the author to ensure that it is as accurate as possible. However, he can’t ensure that there will not be any mistake. To use the information in the article for one’s own investing, the liability shall not be born to the author.

Introduction

CPN is a leader in retail mall development. By Sep 2008, it owns 10 shopping mall having net leasable area of 563,000 sq. m. In addition, it owns 144,000 sq.m. of office area. Revenue is generated primarily from rental fee in retail mall and office with small portion from food & beverage in the retail mall it operates. CPN also earns dividend income from the one-third interest in CPNRF, which owns 2 retail malls, Central Rama 2 and Rama 3.

CPN has plan to open additional 5-7 malls from 2009-2012 and thus expand its retail space by over 300,000 sq.m., a remarkable growth amid the economic crisis. As of this writing (21 Feb 2009), two shopping malls, Changwattana (63,000 sq.m) and Pattaya Beach Festival (54,000 sq.m), was opened. Central Chonburi (39,000 sq.) and Khonkaen (48,700 sq.m) will be opened by mid and late of this year. Three additional malls, Rama 9, Pre-Cadet School Site and Chiangmai2, are in the study phase, which, when completed, will add about 120,000 sq.m.to its retail mall portfolio.

The capital expenditure for the new projects is more than 20,000 billion Baht for the next 4 years.

Shopping malls developed by CPN has such a strong anchor tenant as Central Department Store and other retail specialties in Central Retail Group. Therefore, it is anticipated that the occupancy rate will not drop and it is able to increase the rental fee during this tough time. It would be able to ride the tough time and emerge stronger with its new projects.

With its growth story, this article attempts to determine the intrinsic value of CPN by discounted cash flow method.

Revenue Growth

Through its continuous shopping mall development between 2009 and 2012, the net leasable area for shopping mall is expected to increase progressively from 563,000 sq.m to 884,000 sq.m. or 58% increase. Assuming it can raise the rental fee by 5% annually and maintain an occupancy rate of 96%, its renting revenue for the retail mall will be increased from 7,100 MB in 2008 to 15,800 MB in 2015.

The office renting space will be increased from 144,280 sq.m to 171,280 sq.m in 2009 and no expansion thereafter. Assuming the renting fee is increased by 3% annually and maintain occupancy rate of 95%, its revenue will increase from 880 MB to 1,300 MB.

Revenue from F&B is also included but the contribution is minimal and not mentioned herein.

Gross Profit & EBIT

Gross profit margin is assumed to be 46%, 39% and 20% for retail mall rent, office rent and F&B respectively. By year 2015, total gross profit is expected to be 7,900 MB versus 3,700 MB forecasted for 2008.

Assuming SG&A expense of 20% of total revenue, EBIT for 2015 will be 4,365 MB.

Depreciation and Capital Expenditure

CPN, in Sep 2008, forecasted its capital expenditure for new projects and enhancement of over 20 billion for the next 4 years

For maintenance cost, it is set at 1.025 times the depreication. As for depreciation, CPN charges approximately 5% on in fixed asset annually. Thus, the estimated depreciation on new projects is set at the same rate.

Weighted Average Cost of Capital

As of Q3 2008, Debt to Equity ratio is 1:1. CPN has interest-bearing debt totaling 14,000 MB. Cost of equity and cost of debt is approx 10.69% and 5.4%. Therefore, weighted average cost of capital (WACC) is 7.24%. It is assumed risk free rate of 4.40%, market risk premium of 6.29%, beta of 1.0 and spread of 1.00%.

Present Value of Discounted Free Cash Flow

Free cash flow is calculated as per the following expression: FCF = EBIT(1-T) + DA – CAPEX – CWC. And it is discounted by the WACC of 7.24%. After year 2015, it is assumed no new project is developed and the FCF will increase by 3% for the rest of the period. Corporate tax rate is 30%. Change in working capital is assumed to be 0 as CPN has negative working capital. Present value to the firm is 40,780 MB. As of Q3 2008, CPN has net debt of 11,000 MB (Debt 14,000 MB and Cash 3,000 MB). Therefore the firm equity value is 29,780 MB.

In addition, CPN earns dividend income from the investment in CPNRF. Assuming a dividend growth of 2.5% per annum (Next year dividend of 0.88 Baht per share. CPN owns 33%), the present value of the dividend is 6,760 MB.

Therefore total equity value is 29,780 + 6,760 = 36,540 MB. Given its number of share outstanding of 2,178,816,000 shares, the equity value per share is 16.77 Baht.

Risks and Other concerns

As of writing, CPN is still negotiating with State Railway for lease extension at Central Plaza Ladprao. This evaluation assumed CPN will be granted the right for lease extension. It also assumes no erosion to the gross profit margin.

Post-Publishing Date

On 23 Feb 2009, CPN announced it has enter into agreement with CID to sub-lease the right in Central Ladprao (CID is the main leasor of the site from State Railway. The lease extension was approved). The transaction worth about 16,000 MB paying progressively during the lease period of 20 years which will expire in 2028. Shareholder's meeting will be held early March as this transaction requires shareholder's approval. No other details are available at present.

Sunday, January 25, 2009

The New Journey

Financial journey in the past year (2008) was not pleasant at all as a result of the collapse of the stock markets worldwide. The performance of the fund I manage can't escape the blatant situation as well. Yet, it really teaches me good lessons and provides me opportunities to reshuffle my portfoilo.

Before the sharp decline, I had a remarkable gain in two long-term investments. These two investments started to show some signs of weary, yet I was too complacent. By the time, I cashed out, the value has dropped substantially from its peak.

At the peak of the market in 2008, I found it difficult to get a good bargian I've found a few years ago. Yet, instead of patiently holding cash and awaiting for the opportunity, I kept on investing in fundamentally sound companies though margin of safety is narrowed. The diversion from the "margin of safety" concept costs my portfolio very dear.

And just before the crash approached, I moved to Australia for working in September. At the time I moved, the commodity prices set a record high before tumbling down at a rate we've never seen in history. Fortunately and fortuitously, I managed to come here before the demise of the resource boom. I hope my career here will not end so soon and thus that will give me chances to invest here.

In Australian stock exchange market (ASX), there are plenty of fundamentally sound companies which can be invested for a long term. Unlike SET, it tends to be short lived.

And here is my new journey in the stock market of the Down Under.

Before the sharp decline, I had a remarkable gain in two long-term investments. These two investments started to show some signs of weary, yet I was too complacent. By the time, I cashed out, the value has dropped substantially from its peak.

At the peak of the market in 2008, I found it difficult to get a good bargian I've found a few years ago. Yet, instead of patiently holding cash and awaiting for the opportunity, I kept on investing in fundamentally sound companies though margin of safety is narrowed. The diversion from the "margin of safety" concept costs my portfolio very dear.

And just before the crash approached, I moved to Australia for working in September. At the time I moved, the commodity prices set a record high before tumbling down at a rate we've never seen in history. Fortunately and fortuitously, I managed to come here before the demise of the resource boom. I hope my career here will not end so soon and thus that will give me chances to invest here.

In Australian stock exchange market (ASX), there are plenty of fundamentally sound companies which can be invested for a long term. Unlike SET, it tends to be short lived.

And here is my new journey in the stock market of the Down Under.

Friday, December 07, 2007

WHAT’S SO IMPORTANT ABOUT DIVIDEND?

Most investors prefer (and are happy) to see their company they invest paying them high dividend without realizing that sometimes high dividend paid does not do any good to the company. Dividend can be paid from the after-tax profit and in certain circumstances from the retained earnings accumulated through years of operations. It means the company can pay dividends to its shareholders even if it loses money in that particular year, provided that it has adequate retained earnings meeting the minimum requirement set forth by the regulator. The level of dividend paid out could have impact on the future expansion too, where fresh capital is required.

To pay or not to pay?

Dividend, alone, does not tell us whether or not the company is doing well, i.e. profitable and generating cash. As you can see, the company can dig into the retained earnings to pay its shareholders dividend. Investors should look into other more meaningful indicators, such as Cash Flow Return On Invested Capital (CFROIC). CFROIC is talking in length in Joe Ponzio’s web blog at www.fwallstreets.com and won’t be discussed in details here. In brief, the ratio determines how good the company generates free cash flow from the capital invested. Outstanding companies not only are able to generate high free cash flow compared with invested capital but also re-invest its excess cash for a high return. It’s irrational, in my point of view, for this type of company to pay dividend to its shareholders who are unlikely to churn out the money given for a high return.

Case Study: Thai Rayon

Once a year after Thai Rayon (TR) announces the dividend, minor shareholders always grumble on the low dividend paid-out. For year 2007, it pays the shareholders 1.60 Baht from an EPS of 12.35 Baht. Although this year dividend is substantially increased from last year level at 1.10 Baht, the paid-out ratio is considered minuscule compared to its huge earnings. To determine if it is rational for the company to retain most of its earnings, one needs to look into its future expansion plan as well as the efficiency in churning out profit from its capital employed (CFROIC).

TR announced in August to replace its production line 1 with new production capacity of 100 TPD. The capital expenditure for this expansion is set at 450 MB and will be spent from Oct 2007 to Jun 2008. At the beginning of the year, TR starts building production line 5 with estimated budget of 865 MB. This line will be completed in Mar 2008. TR also sets aside additional 656 MB to build new carbondisulfide plant which is expected to complete in Mar 2008. This newly-built plant will decrease the company’s dependence on charcoal, one of its key raw materials. Apart from these, TR also increased its stake in two pulp and paper plants in Canada, in order to increase its captive of such essential raw material as pulp and paper grade for producing rayon.

Let’s scrutinize closely on the benefit from building production line 5. This line is capable of producing normal VSF at 85 TPD. With realization price at 80,000 Baht per MT, annual revenue is 2,482 MB. Profit margin before interest and tax is estimated to be 30%, therefore, operating profit before interest and tax is 744 MB. With less than 2 years, the production line 5 is breakeven. The margin is affordable to drop down to 17% and this production line still breakeven in 2 years.

Conclusion

So far, I have not seen such a lucrative business listed on the Stock Exchange of Thailand. And I can see why the company decides to re-invest its excessive cash instead of paying it out to shareholders. I believe this will benefit the shareholders most in the long range.

About the author

The author is the founder and fund manager of Diamond Fund established in May 2002. Value investing is the crux of his investment philosophy. As of November 30, 2007, the return of Diamond Fund for YTD (not annualized), 1-year, 3-year and since inception is 49.58%, 47.10%, 119.06% and 307.84% respectively.

Disclaimer

The author has a stake in TR. His opinion given in this article might be prejudiced although he has tried his best to maintain the neutral position. The data presented in this article is carefully verified by the author to ensure that it is as accurate as possible. However, he can’t ensure that there will not be any mistake. To use the information in the article for one’s own investing, the liability shall not be born to the author.

To pay or not to pay?

Dividend, alone, does not tell us whether or not the company is doing well, i.e. profitable and generating cash. As you can see, the company can dig into the retained earnings to pay its shareholders dividend. Investors should look into other more meaningful indicators, such as Cash Flow Return On Invested Capital (CFROIC). CFROIC is talking in length in Joe Ponzio’s web blog at www.fwallstreets.com and won’t be discussed in details here. In brief, the ratio determines how good the company generates free cash flow from the capital invested. Outstanding companies not only are able to generate high free cash flow compared with invested capital but also re-invest its excess cash for a high return. It’s irrational, in my point of view, for this type of company to pay dividend to its shareholders who are unlikely to churn out the money given for a high return.

Case Study: Thai Rayon

Once a year after Thai Rayon (TR) announces the dividend, minor shareholders always grumble on the low dividend paid-out. For year 2007, it pays the shareholders 1.60 Baht from an EPS of 12.35 Baht. Although this year dividend is substantially increased from last year level at 1.10 Baht, the paid-out ratio is considered minuscule compared to its huge earnings. To determine if it is rational for the company to retain most of its earnings, one needs to look into its future expansion plan as well as the efficiency in churning out profit from its capital employed (CFROIC).

TR announced in August to replace its production line 1 with new production capacity of 100 TPD. The capital expenditure for this expansion is set at 450 MB and will be spent from Oct 2007 to Jun 2008. At the beginning of the year, TR starts building production line 5 with estimated budget of 865 MB. This line will be completed in Mar 2008. TR also sets aside additional 656 MB to build new carbondisulfide plant which is expected to complete in Mar 2008. This newly-built plant will decrease the company’s dependence on charcoal, one of its key raw materials. Apart from these, TR also increased its stake in two pulp and paper plants in Canada, in order to increase its captive of such essential raw material as pulp and paper grade for producing rayon.

Let’s scrutinize closely on the benefit from building production line 5. This line is capable of producing normal VSF at 85 TPD. With realization price at 80,000 Baht per MT, annual revenue is 2,482 MB. Profit margin before interest and tax is estimated to be 30%, therefore, operating profit before interest and tax is 744 MB. With less than 2 years, the production line 5 is breakeven. The margin is affordable to drop down to 17% and this production line still breakeven in 2 years.

Conclusion

So far, I have not seen such a lucrative business listed on the Stock Exchange of Thailand. And I can see why the company decides to re-invest its excessive cash instead of paying it out to shareholders. I believe this will benefit the shareholders most in the long range.

About the author

The author is the founder and fund manager of Diamond Fund established in May 2002. Value investing is the crux of his investment philosophy. As of November 30, 2007, the return of Diamond Fund for YTD (not annualized), 1-year, 3-year and since inception is 49.58%, 47.10%, 119.06% and 307.84% respectively.

Disclaimer

The author has a stake in TR. His opinion given in this article might be prejudiced although he has tried his best to maintain the neutral position. The data presented in this article is carefully verified by the author to ensure that it is as accurate as possible. However, he can’t ensure that there will not be any mistake. To use the information in the article for one’s own investing, the liability shall not be born to the author.

Wednesday, June 27, 2007

Half a Decade with Value Investing

On 31st May 2007, it marked another major milestone for me in the investing arena. For 5 years that I have been practicing value investing approach, the outcome is very satisfactory. Over a tenure of 5 years, the net asset value per unit (NAV) of the fund I've managed increases from 10.0000 to 30.2329 Baht or an equivalent of 24.77% compounded annual growth rate. Over the same period, the return from SET Index, SET TRI and SET-50 TRI is 13.76%, 18.33% and 20.35% respectively.

Notably, it is a remarkable performance over 5 years period. It proves that the value-oriented investing method does work and in fact work very well for me. However, there are challenges and uncertainties lying ahead. Opportunity and huge reward are awaiting for those who work hard enough to spot on some of them. There will not be a room for complacency.

Notably, it is a remarkable performance over 5 years period. It proves that the value-oriented investing method does work and in fact work very well for me. However, there are challenges and uncertainties lying ahead. Opportunity and huge reward are awaiting for those who work hard enough to spot on some of them. There will not be a room for complacency.

Thursday, October 05, 2006

AMARIN PRINTING & PUBLISHING PUBLIC COMPANY LIMITED (APRINT)

Company with potential growth, rock solid balance sheet and competent management

Disclaimer

The author has a stake in APRINT. His opinion given in this article might be prejudiced although he has tried his best to maintain the neutral position. The data presented in this article is carefully verified by the author to ensure that it is as accurate as possible. However, he can’t ensure that there will not be any mistake. To use the information in the article for one’s own investing, the liability shall not be born to the author.

What will come first in your mind when talking about Amarin Printing, or APRINT for short? To me, Baan Lae Suan Magazine, Praew Magazine, National Geographic (Thai Edition), Nai-in Bookstore and Davinci Code (Thai Edition). I believe everybody should have heard these names and some might even be the subscribers of those magazines or regular customers/readers of APRINT’s products.

APRINT have, in total, 10 magazines under its name and most of them are the leader in the sector they target. For example, according to the survey carried out by SE-ED in 2005, Baan Lae Suan and Room are the first and second, respectively, in the house and decoration segment.

In addition, APRINT also owns several publishing houses publishing variety of books using the contents in the magazine it published.

Revenue

Revenue of APRINT comes from three main sources, which are printing business, magazine & book business and advertising. These 3 main channels of income account for 90% of total revenue. The remaining 10% is derived from Fair & Event business and Tour & Training business.

Printing Business

Revenue from printing business is accounted for about 30% of total revenue in 2005. It steadily grew from 300 MB in 2003 to 385 MB in 2004 and to 474 MB in 2005. During the past few years, the company is extensively upgrading its printing facilities and infrastructure. This backward linkage investment will improve the quality and efficiency in printing, thereby, reducing the cost of printing its own magazines and books. The proportion between external and internal printing jobs is 53% to 47%. However, the company does not disclose the operating profit margin. The revenue from this channel is expected to grow steadily in line with the growth in sales of the magazines and books.

Advertising

Revenue from advertising, the highest among the three main sources, is accounted for 35% of the total revenue or 520 MB, equivalent to 4% increase from a year ago. In the same period, the advertising expenditure through magazine, according to Nielsen Media Research (Thailand), grew by 8.45% to reach 6,638 MB. The slow growth in this area is attributed to the worried of the corporate to the uncertainties in economy and political situation in Thailand, hence reducing the advertising expenditure. However, once the economy outlook is better, the revenue from advertising will grow as most magazines under APRINT are in the top in the sector they target in.

Magazine & Book

One quarter of the revenue is derived from selling magazine and books. In 2005, it recorded 374 MB compared with 340 MB achieved in 2004. APRINT produces a variety of books ranging from mystery novel, health, dharma, children, etc. Content from its magazines is recompiled and published in books. Potential of growth in this area is high since the rate of reading in Thailand is still relatively low compared to developed countries (In 2005, around 70% of population age above 6 is reading and average time spent for reading is about 2 hours per day). In addition, number of books published will increase along with the expansion of bookstores nationwide by SE-ED.

Gross profit margin from magazine and book business (including revenue from advertising is 20% (constant since 2004).

Content Business – Value Creation

Contents developed for its various magazines are used to expand into event organizing, tour and training, and media business. The revenue in this new area is about 10% of the total revenue. It grew from 88 MB in 2004 to 111 MB in 2005 but operating profit declined from 36 MB to 30 MB (higher cost due to more events organized). APRINT still focuses and attempts to bring out the most from its content in order to generate more revenue and profit.

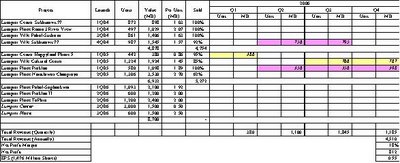

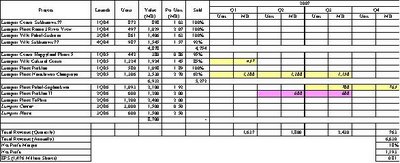

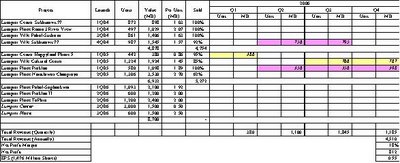

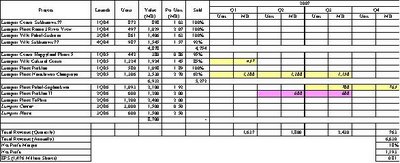

Table below summarizes APRINT’s revenue structure and growth rate from 2001-2005.

Profitability

Although APRINT has managed to increase its revenue in the mid-teen region for the past five years, its net profit growth is erratic. It managed to achieve net profit growth of 69% in 2002 but subsequently the growth rate is hovering around 10% with an exception of year 2003 which saw a growth rate of merely 1% due to a huge loss from its subsidiary.

From the table shown below, the expenses (both cost of goods sold and SG&A) are rising hence reducing the net profit margin. Net profit margin declines from 19% in 2002 to 15% in 2005. As a result of huge capital expenditure outlay a few years ago to upgrade its printing facilities, its net profit will be hampered by larger depreciation. To boost its profit level, APRINT should seriously establish strategy to control operating costs.

Owner’s Earning is rising gradually albeit large CAPEX for upgrading its printing facilities. Once this upgrading campaign is complete, the Owner’s Earning will increase substantially from the current level.

Future Prospect

Advertising Revenue

Adverting expenditure through magazine is stagnant for the first 8 months of 2006, totaling 3690 MB according to Nielsen Media Research (Thailand). Competition is fierce as there are many magazines launched (estimated 1-2 magazines per week). APRINT plan to capture this pie is launching 1-2 new magazines per year (in 2006, SHAPE is launched) and strengthen the presence of its leading magazines. The company expects the advertising expenditure to grow around 8-10%. With this regard, revenue from advertising is expected to grow at the same rate as that of the overall industry.

Printing Revenue

APRINT sees a good growth of revenue from this sector, more than 20% during the past two years. We can expect no less for the coming years as the amount of books and magazines printed is increasing. In addition, the establishment of Commercial Printing Division to penetrate into the printing works for other corporate could bring in more revenue. This will keep its printing facilities running in full capacity. The upgrading will bring in further value through quality printing.

Magazine & Books

Moderate growth can be expected for this year (about 10%). Davinci Code and other unputdownable mystery series, not to mention other categories, attract lots of readers. I hope that the company can churn out more and more of this kind of books. As mentioned above, the reading rate is still very low therefore there are plenty of rooms to grow in the long term. It is just a matter of how much the company can capitalize on this trend.

Content Business

Although content business represents only 10% of total revenue at present but one can’t overlook it as its growth rate is more than 20% during the past years. I believe that the management can bring out the most value from its comprehensive content.

Valuation

My estimates for the next five years are as follows:

Revenue growth from advertising = 5%

Revenue growth from printing = 15%

Revenue growth from magazine & book = 10%

Revenue growth from content business = 20%

Let’s take the figures from 2005 as a base year and project to year 2010. So, in 2010

Revenue from advertising = 663 MB

Revenue from printing = 954 MB

Revenue from magazine & book = 602 MB

Revenue from content business = 276 MB

Total revenue = 2,495 MB (11% CAGR)

Let’s assume the company can maintain the net profit margin at 15%, in year 2010

Net Profit = 374 MB (10% CAGR)

EPS = 1.87 Baht

P/E Ratio = 10 times

Share Price = 18.7 Baht

Let’s further assume that the dividend paid out rate is 60%, along the period of 5 years, the accumulated dividend is amounted to 4.59 Baht per share.

At today’s price (19 Sep 2006) of 11.20 Baht, the expected total shareholder return over the next five years is about 12.10 Baht, doubling the money invested initially (15.8% CAGR).

Conclusion

I think that APRINT can achieve CAGR of revenue and net profit of about 10% over the next five years. APRINT needs to focus on cost controlling so that it can maintain or surpass the net profit margin at this level (15%). I hope that the company does not have to invest heavily in its facilities therefore it can pay high dividend to shareholders. For this case, dividend paid out contributed almost four-tenth of the total return, bringing the CAGR to 15.8% over 5 year period (even with growth of revenue and profit of 10% assumed).

Disclaimer

The author has a stake in APRINT. His opinion given in this article might be prejudiced although he has tried his best to maintain the neutral position. The data presented in this article is carefully verified by the author to ensure that it is as accurate as possible. However, he can’t ensure that there will not be any mistake. To use the information in the article for one’s own investing, the liability shall not be born to the author.

What will come first in your mind when talking about Amarin Printing, or APRINT for short? To me, Baan Lae Suan Magazine, Praew Magazine, National Geographic (Thai Edition), Nai-in Bookstore and Davinci Code (Thai Edition). I believe everybody should have heard these names and some might even be the subscribers of those magazines or regular customers/readers of APRINT’s products.

APRINT have, in total, 10 magazines under its name and most of them are the leader in the sector they target. For example, according to the survey carried out by SE-ED in 2005, Baan Lae Suan and Room are the first and second, respectively, in the house and decoration segment.

In addition, APRINT also owns several publishing houses publishing variety of books using the contents in the magazine it published.

Revenue

Revenue of APRINT comes from three main sources, which are printing business, magazine & book business and advertising. These 3 main channels of income account for 90% of total revenue. The remaining 10% is derived from Fair & Event business and Tour & Training business.

Printing Business

Revenue from printing business is accounted for about 30% of total revenue in 2005. It steadily grew from 300 MB in 2003 to 385 MB in 2004 and to 474 MB in 2005. During the past few years, the company is extensively upgrading its printing facilities and infrastructure. This backward linkage investment will improve the quality and efficiency in printing, thereby, reducing the cost of printing its own magazines and books. The proportion between external and internal printing jobs is 53% to 47%. However, the company does not disclose the operating profit margin. The revenue from this channel is expected to grow steadily in line with the growth in sales of the magazines and books.

Advertising

Revenue from advertising, the highest among the three main sources, is accounted for 35% of the total revenue or 520 MB, equivalent to 4% increase from a year ago. In the same period, the advertising expenditure through magazine, according to Nielsen Media Research (Thailand), grew by 8.45% to reach 6,638 MB. The slow growth in this area is attributed to the worried of the corporate to the uncertainties in economy and political situation in Thailand, hence reducing the advertising expenditure. However, once the economy outlook is better, the revenue from advertising will grow as most magazines under APRINT are in the top in the sector they target in.

Magazine & Book

One quarter of the revenue is derived from selling magazine and books. In 2005, it recorded 374 MB compared with 340 MB achieved in 2004. APRINT produces a variety of books ranging from mystery novel, health, dharma, children, etc. Content from its magazines is recompiled and published in books. Potential of growth in this area is high since the rate of reading in Thailand is still relatively low compared to developed countries (In 2005, around 70% of population age above 6 is reading and average time spent for reading is about 2 hours per day). In addition, number of books published will increase along with the expansion of bookstores nationwide by SE-ED.

Gross profit margin from magazine and book business (including revenue from advertising is 20% (constant since 2004).

Content Business – Value Creation

Contents developed for its various magazines are used to expand into event organizing, tour and training, and media business. The revenue in this new area is about 10% of the total revenue. It grew from 88 MB in 2004 to 111 MB in 2005 but operating profit declined from 36 MB to 30 MB (higher cost due to more events organized). APRINT still focuses and attempts to bring out the most from its content in order to generate more revenue and profit.

Table below summarizes APRINT’s revenue structure and growth rate from 2001-2005.

Profitability

Although APRINT has managed to increase its revenue in the mid-teen region for the past five years, its net profit growth is erratic. It managed to achieve net profit growth of 69% in 2002 but subsequently the growth rate is hovering around 10% with an exception of year 2003 which saw a growth rate of merely 1% due to a huge loss from its subsidiary.

From the table shown below, the expenses (both cost of goods sold and SG&A) are rising hence reducing the net profit margin. Net profit margin declines from 19% in 2002 to 15% in 2005. As a result of huge capital expenditure outlay a few years ago to upgrade its printing facilities, its net profit will be hampered by larger depreciation. To boost its profit level, APRINT should seriously establish strategy to control operating costs.

Owner’s Earning is rising gradually albeit large CAPEX for upgrading its printing facilities. Once this upgrading campaign is complete, the Owner’s Earning will increase substantially from the current level.

Future Prospect

Advertising Revenue

Adverting expenditure through magazine is stagnant for the first 8 months of 2006, totaling 3690 MB according to Nielsen Media Research (Thailand). Competition is fierce as there are many magazines launched (estimated 1-2 magazines per week). APRINT plan to capture this pie is launching 1-2 new magazines per year (in 2006, SHAPE is launched) and strengthen the presence of its leading magazines. The company expects the advertising expenditure to grow around 8-10%. With this regard, revenue from advertising is expected to grow at the same rate as that of the overall industry.

Printing Revenue

APRINT sees a good growth of revenue from this sector, more than 20% during the past two years. We can expect no less for the coming years as the amount of books and magazines printed is increasing. In addition, the establishment of Commercial Printing Division to penetrate into the printing works for other corporate could bring in more revenue. This will keep its printing facilities running in full capacity. The upgrading will bring in further value through quality printing.

Magazine & Books

Moderate growth can be expected for this year (about 10%). Davinci Code and other unputdownable mystery series, not to mention other categories, attract lots of readers. I hope that the company can churn out more and more of this kind of books. As mentioned above, the reading rate is still very low therefore there are plenty of rooms to grow in the long term. It is just a matter of how much the company can capitalize on this trend.

Content Business

Although content business represents only 10% of total revenue at present but one can’t overlook it as its growth rate is more than 20% during the past years. I believe that the management can bring out the most value from its comprehensive content.

Valuation

My estimates for the next five years are as follows:

Revenue growth from advertising = 5%

Revenue growth from printing = 15%

Revenue growth from magazine & book = 10%

Revenue growth from content business = 20%

Let’s take the figures from 2005 as a base year and project to year 2010. So, in 2010

Revenue from advertising = 663 MB

Revenue from printing = 954 MB

Revenue from magazine & book = 602 MB

Revenue from content business = 276 MB

Total revenue = 2,495 MB (11% CAGR)

Let’s assume the company can maintain the net profit margin at 15%, in year 2010

Net Profit = 374 MB (10% CAGR)

EPS = 1.87 Baht

P/E Ratio = 10 times

Share Price = 18.7 Baht

Let’s further assume that the dividend paid out rate is 60%, along the period of 5 years, the accumulated dividend is amounted to 4.59 Baht per share.

At today’s price (19 Sep 2006) of 11.20 Baht, the expected total shareholder return over the next five years is about 12.10 Baht, doubling the money invested initially (15.8% CAGR).

Conclusion

I think that APRINT can achieve CAGR of revenue and net profit of about 10% over the next five years. APRINT needs to focus on cost controlling so that it can maintain or surpass the net profit margin at this level (15%). I hope that the company does not have to invest heavily in its facilities therefore it can pay high dividend to shareholders. For this case, dividend paid out contributed almost four-tenth of the total return, bringing the CAGR to 15.8% over 5 year period (even with growth of revenue and profit of 10% assumed).

Sunday, September 17, 2006

LUMPINI DEVELOPMENT PUBLIC COMPANY LIMITED

On January 22, 2006 I wrote

Disclaimer

The author has a stake in LPN. His opinion given in this article might be prejudiced although he has tried his best to maintain the neutral position. The data presented in this article is carefully verified by the author to ensure that it is as accurate as possible. However, he can’t ensure that there will not be any mistake. To use the information in the article for one’s own investing, the liability shall not be born to the author.

Lumpini Development Public Company Limited (LPN) has caught my attention around a year ago when it advertised its low-to-medium-price condominium project at Sukhumvit 77 on the sky trains. As one of its targeted group who looks for not-so-expensive condominium situated nearby the mass transit network like BTS and MRT, I started on my research four months ago to ascertain if this company is worth owning.

The Blue Ocean

In-house research team of LPN found out that the moderate-price condominiums in the range of 1-3 million Baht and located along the mass transit network route are in high demand but lack of supply. Its flagship projects in Sukhumvit 77 and Pahol-Suthisan area were sold out within a short period. Similar strategy adopted in Pinklao, Cultural Center and Rama 3 area is also successful in drawing out the targeted buyers. As the installment cost is closed to the renting cost, most people are more than willing to own one rather than rent one. The growing trend of Bangkokians to stay close to the office or the mass transit network in order to curtail their transportation cost indicates that the demand in this niche market would still be strong in the foreseeable future. Recent proof on this trend is that its newly launched project, Lumpini Place Pahol-Saphankwai, is in great demand from the buyers. The 30-35 sq.m rooms available during the pre-sale period are sold out within a few days. As the leader in this area, LPN expands its own territory of the huge Blue Ocean.

Competitive Advantage and Risk

LPN is one of the property developers having high efficiency in managing profitability, cost controlling and financial leverage. The operating profit margin is approximately 33% and net profit margin is around 18%. Its SG&A to Revenue Ratio is slightly more than 10%. Only two companies in the property development sector listed on SET achieve lower ratio than what LPN does. Its ROA and ROE stand more than 15% with D/E ratio of 0.63. LPN ranks within the top five companies in the property developer sector in terms of ROA, ROE and D/E.

The future success of LPN hinges very much on the location and price of potential land bank it acquires. A good relationship with financial institutions will make sure that the company has adequate resources for the future projects. Controlling the construction cost will play an important role in enhancing the company’s profitability.

Rising interest rate is probably a major factor prolonging the decision of the would-be buyers. High petrol price will decrease the purchasing power and hence distract the would-be buyers but at the same time will also trigger those who would like to save the transportation cost. The rising in construction materials will dent the company’s operating profit margin as well. Management has to manage the construction cost more carefully in order to maintain the profit margin.

Insofar, as the demand is still strong, I expect that the strategy the company employs will ultimately create the value for the shareholders.

Valuation

With reference to the Table 1 given below, LPN expects that it will recognize its revenue for fiscal year 2006 in the amount of 4,500 million Baht from its four projects launched last year which are over 90% sold out as of 31 Dec 2005. Assuming the net profit margin of 18%, the net profit for year 2006 will be 812 million Baht or 0.55 Baht per share. In addition, the sales volume for this year may top 8,000 million Baht.

The company forecasts that in 2007 its revenue will reach 6,600 million Baht from the projects launched in year 2005 and 2006. Assuming that all units are sold out and the company can maintain its net profit margin at 18%, the net profit for year 2007 will be 1,188 million Baht or 0.80 Baht per year.

If the market values the company at 10 times its earning, the share price would reach 8 Baht in a few years. Given its high dividend payout at 50%, the shareholders would receive the aggregate dividend of 0.85 Baht (0.20, 0.25 and 0.40 for 2005, 2006 and 2007 respectively).

At the current price of 4.02 Baht (20 Jan 2006), the company looks very attractive and undervalued. Most brokerage analyst gives the company a fair value of around 4.40 Baht. But I’d rather prefer to think otherwise. Instead of buying a 30-sq.m room today, one might use that amount of money to purchase the company common stock and wait patiently till the gap between the share price and intrinsic value is closed. At the end, the capital gain and dividend received might translate into a 60-sq.m room.

The last word

I would like to emphasize that investing in this type of company the investor must monitor several figures such as the sales volume and the economic trend quite closely. This will ensure that the investor knows the red flags if occur before hand and is able to exit before others once things do not go as expected.

Disclaimer

The author has a stake in LPN. His opinion given in this article might be prejudiced although he has tried his best to maintain the neutral position. The data presented in this article is carefully verified by the author to ensure that it is as accurate as possible. However, he can’t ensure that there will not be any mistake. To use the information in the article for one’s own investing, the liability shall not be born to the author.

Lumpini Development Public Company Limited (LPN) has caught my attention around a year ago when it advertised its low-to-medium-price condominium project at Sukhumvit 77 on the sky trains. As one of its targeted group who looks for not-so-expensive condominium situated nearby the mass transit network like BTS and MRT, I started on my research four months ago to ascertain if this company is worth owning.

The Blue Ocean

In-house research team of LPN found out that the moderate-price condominiums in the range of 1-3 million Baht and located along the mass transit network route are in high demand but lack of supply. Its flagship projects in Sukhumvit 77 and Pahol-Suthisan area were sold out within a short period. Similar strategy adopted in Pinklao, Cultural Center and Rama 3 area is also successful in drawing out the targeted buyers. As the installment cost is closed to the renting cost, most people are more than willing to own one rather than rent one. The growing trend of Bangkokians to stay close to the office or the mass transit network in order to curtail their transportation cost indicates that the demand in this niche market would still be strong in the foreseeable future. Recent proof on this trend is that its newly launched project, Lumpini Place Pahol-Saphankwai, is in great demand from the buyers. The 30-35 sq.m rooms available during the pre-sale period are sold out within a few days. As the leader in this area, LPN expands its own territory of the huge Blue Ocean.

Competitive Advantage and Risk

LPN is one of the property developers having high efficiency in managing profitability, cost controlling and financial leverage. The operating profit margin is approximately 33% and net profit margin is around 18%. Its SG&A to Revenue Ratio is slightly more than 10%. Only two companies in the property development sector listed on SET achieve lower ratio than what LPN does. Its ROA and ROE stand more than 15% with D/E ratio of 0.63. LPN ranks within the top five companies in the property developer sector in terms of ROA, ROE and D/E.

The future success of LPN hinges very much on the location and price of potential land bank it acquires. A good relationship with financial institutions will make sure that the company has adequate resources for the future projects. Controlling the construction cost will play an important role in enhancing the company’s profitability.

Rising interest rate is probably a major factor prolonging the decision of the would-be buyers. High petrol price will decrease the purchasing power and hence distract the would-be buyers but at the same time will also trigger those who would like to save the transportation cost. The rising in construction materials will dent the company’s operating profit margin as well. Management has to manage the construction cost more carefully in order to maintain the profit margin.

Insofar, as the demand is still strong, I expect that the strategy the company employs will ultimately create the value for the shareholders.

Valuation

With reference to the Table 1 given below, LPN expects that it will recognize its revenue for fiscal year 2006 in the amount of 4,500 million Baht from its four projects launched last year which are over 90% sold out as of 31 Dec 2005. Assuming the net profit margin of 18%, the net profit for year 2006 will be 812 million Baht or 0.55 Baht per share. In addition, the sales volume for this year may top 8,000 million Baht.

The company forecasts that in 2007 its revenue will reach 6,600 million Baht from the projects launched in year 2005 and 2006. Assuming that all units are sold out and the company can maintain its net profit margin at 18%, the net profit for year 2007 will be 1,188 million Baht or 0.80 Baht per year.

If the market values the company at 10 times its earning, the share price would reach 8 Baht in a few years. Given its high dividend payout at 50%, the shareholders would receive the aggregate dividend of 0.85 Baht (0.20, 0.25 and 0.40 for 2005, 2006 and 2007 respectively).

At the current price of 4.02 Baht (20 Jan 2006), the company looks very attractive and undervalued. Most brokerage analyst gives the company a fair value of around 4.40 Baht. But I’d rather prefer to think otherwise. Instead of buying a 30-sq.m room today, one might use that amount of money to purchase the company common stock and wait patiently till the gap between the share price and intrinsic value is closed. At the end, the capital gain and dividend received might translate into a 60-sq.m room.

The last word

I would like to emphasize that investing in this type of company the investor must monitor several figures such as the sales volume and the economic trend quite closely. This will ensure that the investor knows the red flags if occur before hand and is able to exit before others once things do not go as expected.