Sunday, September 17, 2006

LUMPINI DEVELOPMENT PUBLIC COMPANY LIMITED

On January 22, 2006 I wrote

Disclaimer

The author has a stake in LPN. His opinion given in this article might be prejudiced although he has tried his best to maintain the neutral position. The data presented in this article is carefully verified by the author to ensure that it is as accurate as possible. However, he can’t ensure that there will not be any mistake. To use the information in the article for one’s own investing, the liability shall not be born to the author.

Lumpini Development Public Company Limited (LPN) has caught my attention around a year ago when it advertised its low-to-medium-price condominium project at Sukhumvit 77 on the sky trains. As one of its targeted group who looks for not-so-expensive condominium situated nearby the mass transit network like BTS and MRT, I started on my research four months ago to ascertain if this company is worth owning.

The Blue Ocean

In-house research team of LPN found out that the moderate-price condominiums in the range of 1-3 million Baht and located along the mass transit network route are in high demand but lack of supply. Its flagship projects in Sukhumvit 77 and Pahol-Suthisan area were sold out within a short period. Similar strategy adopted in Pinklao, Cultural Center and Rama 3 area is also successful in drawing out the targeted buyers. As the installment cost is closed to the renting cost, most people are more than willing to own one rather than rent one. The growing trend of Bangkokians to stay close to the office or the mass transit network in order to curtail their transportation cost indicates that the demand in this niche market would still be strong in the foreseeable future. Recent proof on this trend is that its newly launched project, Lumpini Place Pahol-Saphankwai, is in great demand from the buyers. The 30-35 sq.m rooms available during the pre-sale period are sold out within a few days. As the leader in this area, LPN expands its own territory of the huge Blue Ocean.

Competitive Advantage and Risk

LPN is one of the property developers having high efficiency in managing profitability, cost controlling and financial leverage. The operating profit margin is approximately 33% and net profit margin is around 18%. Its SG&A to Revenue Ratio is slightly more than 10%. Only two companies in the property development sector listed on SET achieve lower ratio than what LPN does. Its ROA and ROE stand more than 15% with D/E ratio of 0.63. LPN ranks within the top five companies in the property developer sector in terms of ROA, ROE and D/E.

The future success of LPN hinges very much on the location and price of potential land bank it acquires. A good relationship with financial institutions will make sure that the company has adequate resources for the future projects. Controlling the construction cost will play an important role in enhancing the company’s profitability.

Rising interest rate is probably a major factor prolonging the decision of the would-be buyers. High petrol price will decrease the purchasing power and hence distract the would-be buyers but at the same time will also trigger those who would like to save the transportation cost. The rising in construction materials will dent the company’s operating profit margin as well. Management has to manage the construction cost more carefully in order to maintain the profit margin.

Insofar, as the demand is still strong, I expect that the strategy the company employs will ultimately create the value for the shareholders.

Valuation

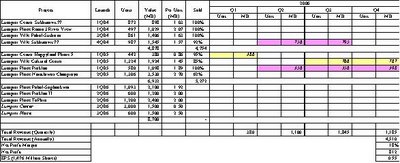

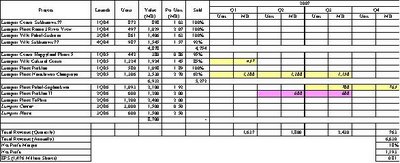

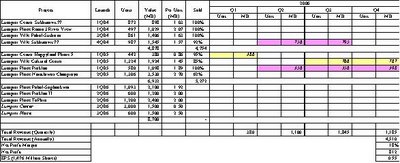

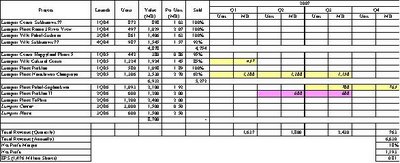

With reference to the Table 1 given below, LPN expects that it will recognize its revenue for fiscal year 2006 in the amount of 4,500 million Baht from its four projects launched last year which are over 90% sold out as of 31 Dec 2005. Assuming the net profit margin of 18%, the net profit for year 2006 will be 812 million Baht or 0.55 Baht per share. In addition, the sales volume for this year may top 8,000 million Baht.

The company forecasts that in 2007 its revenue will reach 6,600 million Baht from the projects launched in year 2005 and 2006. Assuming that all units are sold out and the company can maintain its net profit margin at 18%, the net profit for year 2007 will be 1,188 million Baht or 0.80 Baht per year.

If the market values the company at 10 times its earning, the share price would reach 8 Baht in a few years. Given its high dividend payout at 50%, the shareholders would receive the aggregate dividend of 0.85 Baht (0.20, 0.25 and 0.40 for 2005, 2006 and 2007 respectively).

At the current price of 4.02 Baht (20 Jan 2006), the company looks very attractive and undervalued. Most brokerage analyst gives the company a fair value of around 4.40 Baht. But I’d rather prefer to think otherwise. Instead of buying a 30-sq.m room today, one might use that amount of money to purchase the company common stock and wait patiently till the gap between the share price and intrinsic value is closed. At the end, the capital gain and dividend received might translate into a 60-sq.m room.

The last word

I would like to emphasize that investing in this type of company the investor must monitor several figures such as the sales volume and the economic trend quite closely. This will ensure that the investor knows the red flags if occur before hand and is able to exit before others once things do not go as expected.

Disclaimer

The author has a stake in LPN. His opinion given in this article might be prejudiced although he has tried his best to maintain the neutral position. The data presented in this article is carefully verified by the author to ensure that it is as accurate as possible. However, he can’t ensure that there will not be any mistake. To use the information in the article for one’s own investing, the liability shall not be born to the author.

Lumpini Development Public Company Limited (LPN) has caught my attention around a year ago when it advertised its low-to-medium-price condominium project at Sukhumvit 77 on the sky trains. As one of its targeted group who looks for not-so-expensive condominium situated nearby the mass transit network like BTS and MRT, I started on my research four months ago to ascertain if this company is worth owning.

The Blue Ocean

In-house research team of LPN found out that the moderate-price condominiums in the range of 1-3 million Baht and located along the mass transit network route are in high demand but lack of supply. Its flagship projects in Sukhumvit 77 and Pahol-Suthisan area were sold out within a short period. Similar strategy adopted in Pinklao, Cultural Center and Rama 3 area is also successful in drawing out the targeted buyers. As the installment cost is closed to the renting cost, most people are more than willing to own one rather than rent one. The growing trend of Bangkokians to stay close to the office or the mass transit network in order to curtail their transportation cost indicates that the demand in this niche market would still be strong in the foreseeable future. Recent proof on this trend is that its newly launched project, Lumpini Place Pahol-Saphankwai, is in great demand from the buyers. The 30-35 sq.m rooms available during the pre-sale period are sold out within a few days. As the leader in this area, LPN expands its own territory of the huge Blue Ocean.

Competitive Advantage and Risk

LPN is one of the property developers having high efficiency in managing profitability, cost controlling and financial leverage. The operating profit margin is approximately 33% and net profit margin is around 18%. Its SG&A to Revenue Ratio is slightly more than 10%. Only two companies in the property development sector listed on SET achieve lower ratio than what LPN does. Its ROA and ROE stand more than 15% with D/E ratio of 0.63. LPN ranks within the top five companies in the property developer sector in terms of ROA, ROE and D/E.

The future success of LPN hinges very much on the location and price of potential land bank it acquires. A good relationship with financial institutions will make sure that the company has adequate resources for the future projects. Controlling the construction cost will play an important role in enhancing the company’s profitability.

Rising interest rate is probably a major factor prolonging the decision of the would-be buyers. High petrol price will decrease the purchasing power and hence distract the would-be buyers but at the same time will also trigger those who would like to save the transportation cost. The rising in construction materials will dent the company’s operating profit margin as well. Management has to manage the construction cost more carefully in order to maintain the profit margin.

Insofar, as the demand is still strong, I expect that the strategy the company employs will ultimately create the value for the shareholders.

Valuation

With reference to the Table 1 given below, LPN expects that it will recognize its revenue for fiscal year 2006 in the amount of 4,500 million Baht from its four projects launched last year which are over 90% sold out as of 31 Dec 2005. Assuming the net profit margin of 18%, the net profit for year 2006 will be 812 million Baht or 0.55 Baht per share. In addition, the sales volume for this year may top 8,000 million Baht.

The company forecasts that in 2007 its revenue will reach 6,600 million Baht from the projects launched in year 2005 and 2006. Assuming that all units are sold out and the company can maintain its net profit margin at 18%, the net profit for year 2007 will be 1,188 million Baht or 0.80 Baht per year.

If the market values the company at 10 times its earning, the share price would reach 8 Baht in a few years. Given its high dividend payout at 50%, the shareholders would receive the aggregate dividend of 0.85 Baht (0.20, 0.25 and 0.40 for 2005, 2006 and 2007 respectively).

At the current price of 4.02 Baht (20 Jan 2006), the company looks very attractive and undervalued. Most brokerage analyst gives the company a fair value of around 4.40 Baht. But I’d rather prefer to think otherwise. Instead of buying a 30-sq.m room today, one might use that amount of money to purchase the company common stock and wait patiently till the gap between the share price and intrinsic value is closed. At the end, the capital gain and dividend received might translate into a 60-sq.m room.

The last word

I would like to emphasize that investing in this type of company the investor must monitor several figures such as the sales volume and the economic trend quite closely. This will ensure that the investor knows the red flags if occur before hand and is able to exit before others once things do not go as expected.